In 2025, insurance is no longer just about risk management. It’s about operational intelligence.

Welcome to the era of Autonomous Business Operations (ABO), where workflows don’t just run, they think, learn, and optimize themselves.

What Are Autonomous Business Ops?

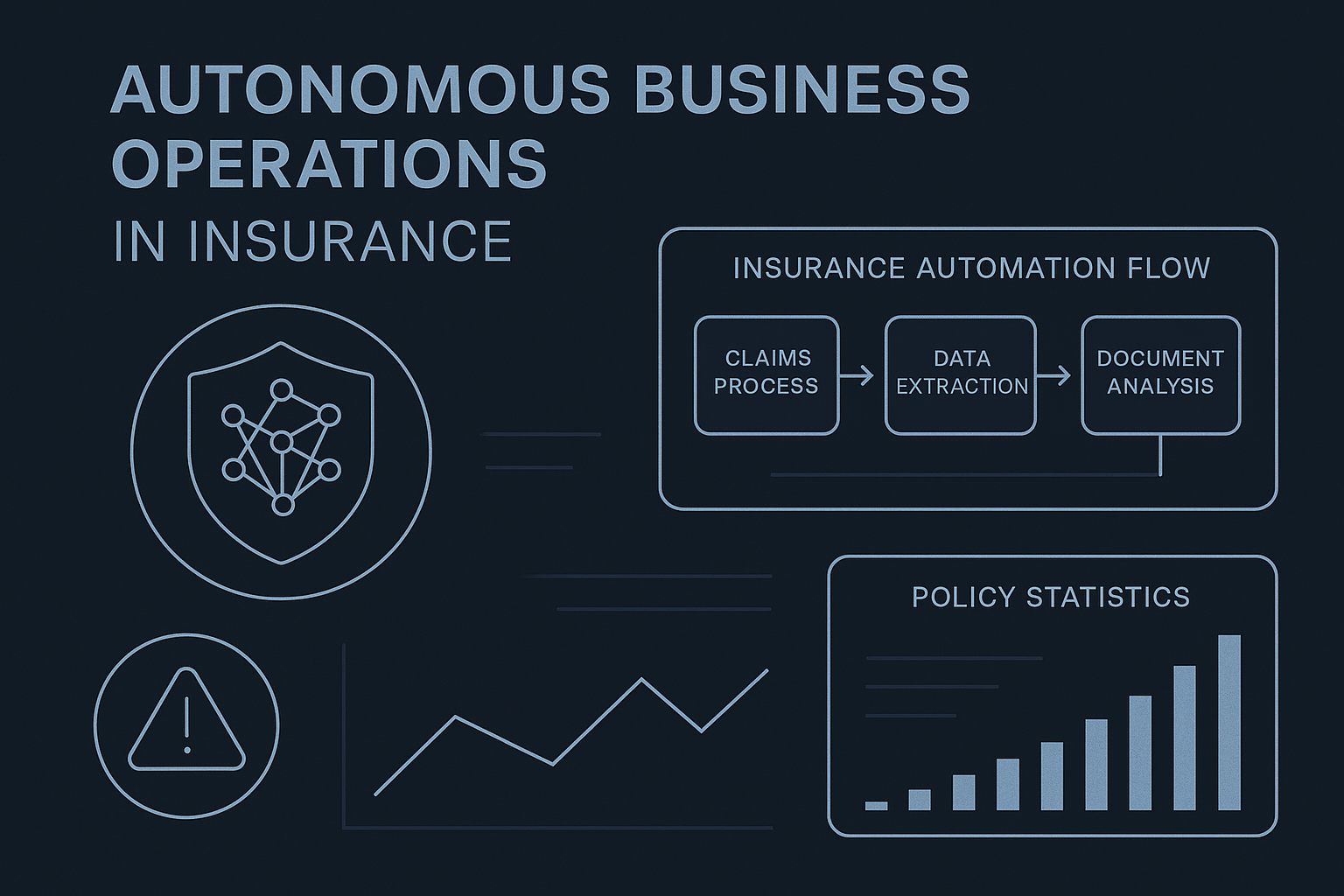

Autonomous Business Operations use AI, automation, and data to handle complex business processes with minimal human input. Think claim assessments that self-validate, policy underwriting that adjusts in real time, or customer queries resolved before a human even logs in.

This isn’t science fiction, it’s being deployed today.

Why Insurance Leaders Are Moving Fast on ABO

In an industry where margins are tight and expectations are high, autonomous systems offer a triple advantage:

- Cost Efficiency – By automating repetitive processes like claims triage, document handling, and compliance checks, firms are saving up to 40% in operations costs.

- Faster Customer Response – With AI handling first-level support, firms report up to 60% faster resolution times.

- Regulatory Confidence – Built-in checks mean fewer human errors and better audit trails.

Use Case: Autonomous Claims Intake

Imagine this: A client files a motor insurance claim. The system-

- Accepts the input via chatbot.

- Extracts data using OCR and validates policy details in real time.

- Assigns the case based on priority or even initiates instant settlement based on rules.

- Updates the CRM and compliance logs without manual entry.

All in under 2 minutes.

That’s ABO in action.

How to Start Adopting ABO in Insurance

If you’re in leadership, here’s where you should focus first:

- Customer-Facing Automation – AI chatbots, auto-generated policies, smart onboarding.

- Operational AI – Intelligent underwriting, fraud detection, risk scoring.

- Backend Orchestration – Auto-updating records, regulatory reporting, task routing.

Tools like Salesforce Financial Services Cloud, Agentforce, and low-code platforms make it easier than ever to pilot and scale autonomous processes.

Final Thoughts

By 2027, Gartner predicts that 40% of operations will be fully autonomous in data-driven industries like insurance.

If you’re not planning for it in 2025, you’re already behind.

Let your operations think for themselves.

The ROI will speak for itself.

Want to see what autonomous ops could look like for your business?

DM us. Let’s talk.

#AutonomousBusiness #InsuranceTech #Salesforce #AIinInsurance #CustomerExperience #BusinessOps #B2Bservices #InsuranceLeaders #Agentforce #DigitalTransformation #ABO #Aekot #AekotAdvantage